MyKplan is an online platform that provides employees access to their employer-sponsored retirement savings plan. The platform offers a variety of benefits that make it easier for employees to manage their retirement savings and plan for their financial future.

Some of the key benefits of MyKplan include user-friendly navigation, personalized investment options, automated contributions, and access to financial education resources.

Here are a few Mykplan Benefits:

MyKplan is an online platform that provides employees with many benefits when managing their employer-sponsored retirement savings plan. Here are 10 MyKplan benefits to help employees plan for their financial future.

User-Friendly Navigation

One of the primary benefits of MyKplan is its user-friendly interface, making it easy for employees to navigate and find the information they need. The platform provides clear and concise instructions for accessing account details, viewing investment options, and making contributions.

Personalized Investment Options

MyKplan provides employees with a range of investment options to choose from based on their individual needs and risk tolerance. This includes a variety of investment strategies, such as mutual funds and index funds, allowing employees to build a diversified portfolio that aligns with their retirement goals.

Automated Contributions

MyKplan makes it easy for employees to contribute to their retirement savings plan, allowing them to set up automatic contributions from their paychecks. This ensures that employees regularly add to their savings without remembering to do so manually.

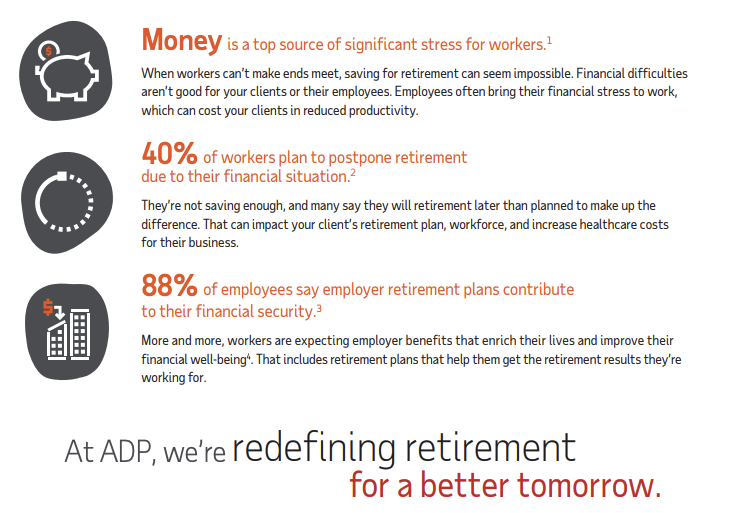

Employer Matching Contributions

Many employers offer matching contributions to their employees’ retirement savings plans. MyKplan makes it easy for employees to see how much their employer contributes and ensure they take advantage of this benefit.

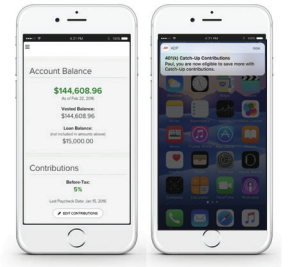

Mobile Access

MyKplan is accessible on mobile devices, making it easy for employees to manage their retirement savings. This allows employees to stay up-to-date on their account details and make adjustments to their savings plan at any time.

Retirement Planning Tools

MyKplan offers a range of retirement planning tools, such as calculators and retirement income projections, to help employees plan for their financial future. These tools can help employees determine how much they need to save for retirement and create a plan to reach their goals.

Access to Financial Education Resources

MyKplan provides employees access to various financial education resources, including articles, webinars, and podcasts. These resources can help employees improve their financial literacy and make informed decisions about their retirement savings plan.

Security and Privacy

MyKplan is designed with security and privacy, providing employees peace of mind when managing their retirement savings. The platform uses advanced encryption technology to protect personal and financial information, ensuring that employees’ data is secure.

Online Support

MyKplan offers online support to employees who have questions or need assistance with their retirement savings plan. The platform provides easy-to-follow instructions for contacting customer support, ensuring that employees can get the help they need when they need it.

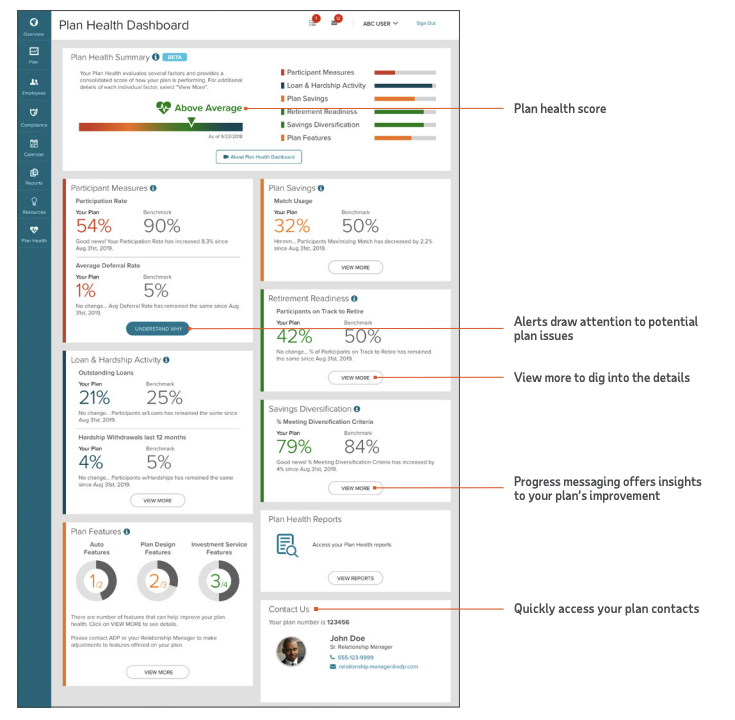

Customizable Dashboard

MyKplan provides employees with a customizable dashboard, allowing them to view and manage their retirement savings plan easily. This includes tracking account balances, viewing investment performance, and making contributions.

Conclusion

In conclusion, MyKplan provides various benefits that make it easier for employees to manage their retirement savings and plan for their financial future. The platform’s user-friendly navigation, personalized investment options, and automated contributions allow employees to take control of their retirement savings and make informed decisions about their financial future.